Privacy Again At Stake in BEPS Fight

Written by Brian Garst, Posted in Taxes

Originally published in Cayman Financial Review

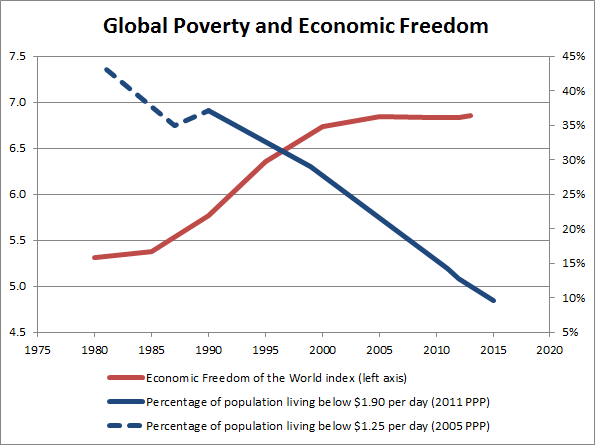

Problems with the OECD’s work on Base Erosion and Profit Shifting (BEPS) are numerous and will likely lead to a variety of negative consequences. Most obvious is the wasted effort put into a massive and costly undertaking seeking to address a problem that the organization’s own data on corporate tax revenues suggests isn’t serious or may not even exist. Also apparent is that the effort is a continuation of the war on tax competition by high-tax nations that resent low-tax jurisdictions that successfully compete for investment, and insofar as tax competition is good for economic growth BEPS is sure to be bad for it. Yet the BEPS project’s impact on privacy might be its most insidious outcome.

The rallying cry of the OECD and its proponents is transparency, e.g. the Global Forum on Transparency and Exchange of Information for Tax Purposes, but they don’t confine the word to its traditional meaning. BEPS in fact represents the latest in a worrying trend that has seen the commonly understood idea of transparency as it relates to public policy completely turned on its head.

Once used exclusively to refer to a key ingredient of good government whereby elected officials and government agencies were open and accountable to the people, tax crusaders have given transparency an Orwellian twist, distorting the idea to mean the elimination of privacy. They want the financial data of citizens naked and exposed to government, which makes their use of transparency an example of upside-down language designed to obscure the evisceration of a basic right.

Privacy’s role

This effort to make transparency an obligation of individuals and private institutions to the state, rather than the other way around, is concerning for a multitude of reasons. In terms of raw power, individuals are vastly outmatched by government. To avoid the kinds of abuses this has led to throughout most of human history, modern and civilized governments are encumbered by legal and democratic constraints, among them strict limits on the degree to which they can access private information.

For those trapped under corrupt regimes, the relationship between privacy and human rights has long been obvious. When your government is able to expropriate your wealth whenever it pleases, you by necessity must understand the importance of financial discretion.

But privacy matters even in Western nations that typically consider themselves above such problems. While outright theft is less likely, it’s not unusual for private information to be exploited by the ruling regime, particularly when it comes to their political opponents. Finally, there is the danger of governments and their typically poor security measures allowing criminals and bad actors inadvertent access to personal data.

Steady erosion of protections

Exploiting what are often exaggerated if not entirely made up crises has allowed governments to gradually erode privacy protections. In other areas – like surveillance and national security – citizens in many nations are starting to fight back, but the continued erosion of financial privacy has seen far less public attention.

When the OECD’s 1998 “Harmful Tax Competition” declaration of war on low-tax jurisdictions met with political backlash, its proponents shifted course to focus more on so-called transparency than low tax rates. The end goal is the same, however, as the elimination of privacy allows for greater use of worldwide tax systems or other back-door harmonization schemes.

The 9/11 terrorist attacks on the United States in 2001 provided an excuse to drastically increase surveillance on financial activities. But even though those involved in the attacks banked in the U.S. and used facilitators in Germany and the UAE, opportunist political rhetoric tellingly singled out tax havens in order to justify the new “transparency” push.

Terrorism quickly gave way to tax evasion as the dominant scare requiring curtailment of rights. What followed was a gradual but persistent effort to chip away at privacy protections, with smaller invasions giving way to bigger and bigger demands and culminating in the United States’ global financial surveillance law, FATCA, along with the current effort to establish automatic exchange of information as the new “global standard.”

Same strategy against new target

BEPS can only be understood as part of the same fight, but the effort also stands apart by focusing on corporate rather than individual taxpayers. This adds an additional economic consequence to its privacy invasions.

Of particular concern are the country-by-country reporting rules, as well as the master and local files. These proposed requirements necessitate that companies hand over information with little to no direct tax relevance, which is very troubling since it presumes that governments have a right to know the internal decision-making processes and strategic technology of companies. To make matters worse, giving this type of info to governments creates a huge risk that proprietary data will be leaked and/or stolen in ways that undermine the competitive edge of companies.

With such information being potentially required in every jurisdiction in which a company does business, improper dissemination is all but certain. It only takes one government with poor safeguards or malicious intent for proprietary information to end up in the hands of competitors. Just imagine what happens when the Chinese and Russian governments have access to sensitive information about the internal workings of Western-based multinationals.

But you don’t even need to assume bad intent. As recent events in the United States have shown, even the world’s largest tax agency can’t protect its citizens’ data from hackers or careless agents. It’s foolish to expect that in the case of BEPS, both it and every other nation will suddenly and without exception provide for the protection of corporate data.

Changing winds?

It’s already common to hear that financial privacy is dead, and given current trends that’s an understandable sentiment, but this isn’t necessarily the end of the story. FATCA, perhaps the biggest of the many current overreaches targeting individual taxpayers, is receiving significant pushback through legal challenges in multiple countries, as well as growing political opposition.

BEPS, too, is beginning to receive long overdue questioning. The process was deliberately rushed to obscure the true extent of its goals and the costs of its questionable means, but it’s not yet a done deal no matter what its boosters may claim.

Key figures in the U.S., including Senate Finance Committee Chairman Orrin Hatch and House Ways and Means Chairman Paul Ryan, have questioned the OECD’s work on BEPS, its ostensible benefit to the United States, and the ability of Treasury Department officials to implement its recommendations without Congressional action. Unless the partisan composition of the U.S. Congress drastically changes in the next election, BEPS is a non-starter in the U.S. for the near future. If other nations follow its lead, the bureaucratic spectacle of the last two years could lead to only limited action.

Conclusion

There’s an ongoing global war between tax collectors on one side and taxpayers and their financial institutions on the other. It is taking place on multiple fronts, and for the time being the tax collectors appear to be winning. If they prevail it won’t just be taxpayers that are defeated, however, but our very understanding of privacy itself.

I serve as Vice President of the Center for Freedom and Prosperity, a non-profit think tank dedicated to preserving tax competition and free markets. This site features my personal views, which are not reflective of CF&P.

I serve as Vice President of the Center for Freedom and Prosperity, a non-profit think tank dedicated to preserving tax competition and free markets. This site features my personal views, which are not reflective of CF&P.