Getting Better All The Time

Written by Brian Garst, Posted in Economics & the Economy, Free Markets

You wouldn’t know it from the popularity of Thomas Piketty’s anti-capitalism treatise, or the Pope’s routine railing against free markets, but the world is getting ever more prosperous. The dramatic decline in global poverty in the last few decades is nothing short of remarkable.

According to a recent World Bank report, extreme poverty is expected to fall below 10% by the end of 2015, which will be a first in human history. I mentioned a few other improvements in a recent EveryJoe column chastising the Pope for spreading economic ignorance:

Across a variety of metrics, life continues to get better and better. Extreme poverty – measuring those living on $2 per day or less – has been cut in half since 1981 and will be all but eliminated by 2030. Global GDP per person has never been higher. Pick a measure of human wellbeing and it’s virtually the same story over and over again: life expectancy is up, infant mortality rates have plummeted, women are better represented in governments than ever before, etc. etc.

The world is simply not the horrible place the pope describes. It is better than it ever has been and we have precisely those institutions that he savages to thank for it.

Over at Cato, Ian Vásquez ties the decline in global poverty to the spread of economic freedom:

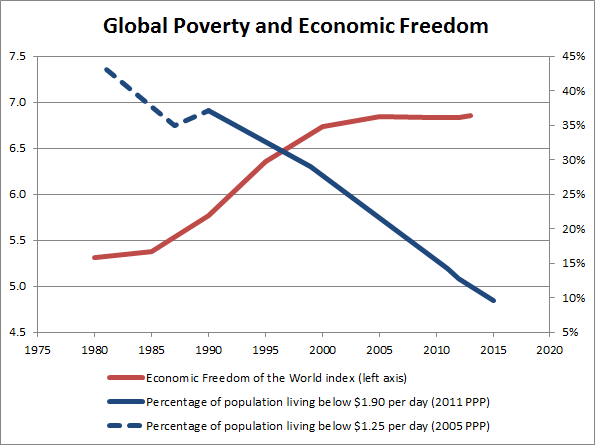

Using updated methodology, the World Bank recalculated poverty figures back to 1990. The new data track closely with previous Bank figures, which I use in the graph to show the fall in poverty since the early 1980s when 43 percent of the world’s population was extremely poor…The drop in poverty also coincides with a significant increase in global economic freedom, beginning with China’s reforms some 35 years ago and the globalization that followed the collapse of central planning in the late 1980s and early 1990s.

Much more could be said on that point, but there are any number of examples demonstrated the superiority of market freedom when it comes to producing wealth (Argentina versus Chile, Venezuela versus Singapore, etc.). Yet the more things get better, the more we seem to worry that they’re not. As the totality of social problems decreases, we devote more energy to those that remain. Which in many ways is healthy. A benefit of being better off overall is that we need not tolerate things which we had no choice but to accept in the past.

But we must be careful not to lose perspective. Exaggerating current problems can lead to poor policy choices if it causes us to disregard the means by which we achieved our current prosperity in the first place.

I serve as Vice President of the Center for Freedom and Prosperity, a non-profit think tank dedicated to preserving tax competition and free markets. This site features my personal views, which are not reflective of CF&P.

I serve as Vice President of the Center for Freedom and Prosperity, a non-profit think tank dedicated to preserving tax competition and free markets. This site features my personal views, which are not reflective of CF&P.